Everyone wants to live a tension-free life during their old age time or retirement time because this age is the end of childhood and adulthood, now you have the time to relax and enjoy life with your family or friends. But still, many retirements don’t end happily mode because of financial issues or bank balance, so by taking this issue as a serious concern Government of India has launched the Atal Pension Yojana (APY) which aims to ensure that low-income people have a reliable source of income when they reach retirement.

This program was launched by our Honorable PM Shri Narendra Modi in 2015 with the clear aim of assisting individuals who are currently working in the unorganized sector. The APY program is a voluntary program that helps people save money for their retirement and this program also incentivizes saving for retirement among residents who are eligible for the program.

The Primary Objectives of Atal Pension Yojan

The primary objective of Atal Pension Yojana is to empower employees in unorganized industries by providing them with benefits as well as the means to support themselves financially on their terms, while it is the social security plan for the people who want to live their future without any financial issues. Now let’s look at the primary objectives of the APY and how it stable source of income

- Provide pension to the workers in the unorganized sector – Atal Pension Yojana primarily targets workers who work in the unorganized sector or who often lack access to the formal pension scheme, while this includes individuals such as laborers, self-employed workers, and the other people who don’t have any backup for their finance.

- Encourage A Saving Culture – By encouraging individuals to contribute to a pension fund regularly, so APY aims to instill the habit of saving among low-income workers, ensuring they set aside money for their future needs, and the scheme is also designed to include more people in the financial system.

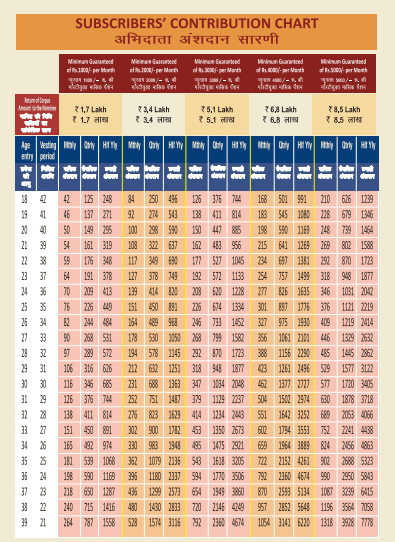

- Flexible Contribution Option – Atal Pension Yojana offers diverse annuity sums extending from INR 1,000 to INR 5,000 per month, permitting people to select an arrangement that best suits their budgetary capabilities and retirement goals. The commitment sums are outlined to be reasonable, making it simpler for low-income people to take part in the plot.

- Easy Enrollment Process – The Yojana is easy to join with the straightforward enrollment process through the bank and post office, while it aims to remove barriers to entry and make pension planning accessible to everyone. If you are contributing to the fund then the amount will be directly debited from your bank without any manual intervention.

- Ensure Financial Independence In Old Age – APY aims to provide a guaranteed minimum pension to subscribe to after they reach the age of 60, ensuring financial independence during their retirement years.

Also Read:- Aadhar Card Loan Yojana || Pradhan Mantri Vaya Vandana Yojana || Pradhan Mantri Matru Vandana Yojana Eligibility

Take A Step to Register For Atal Pension Yojan

The registration process for the Atal Pension Yojana (APY) is the easiest process where lots of people register every year to make their old age time safe and secure, while as per the government data, 71% of the registration is done by the public sector banks and on the hand 19% are carried out by the regional rural banks. Now let’s look at the points of how to register for the Yojana

- When you are going to register for the yojana, you must be aware that your age should be between 18 -40 years to apply for it.

- Then visit the nearest bank of your area or region that participates in the APY scheme, so most of the nationalized and private banks offer APY enrollment services, or the form is also available on the official website of APY.

- When you get the form fill it up with the required details it like name, Aadhar number, date of birth, and many more. Make sure to give the exact details and your bank account as well.

- After filling out the form check if the details you have filled is correct and then hand over the form to the office representative.

- After submitting the form the bank will inform you of the monthly contribution amount based onyour chosen pension and age.

- When your application is processed you will receive an sms alert on your registered mobile number regarding the activation of your APY account and subsequent contribution.

| People Also Ask Q – How to avoid penalties on the Atal Pension Yojana account? A – To avoid the penalty on your APY account make sure that your bank account has sufficient balance to cover the monthly deposit of your plan. |

How to Apply For Atal Pension Yojana APY Without (Net Banking Or App)

People who have bank accounts but don’t utilize versatile apps or internet banking don’t ought to be concerned in any way. They will before long discover that making an account beneath the Atal Annuity Yojana is basic and helpful.

Existing holders of reserve funds accounts will be able to start elective onboarding channels after the Benefits Support Administrative and Advancement Specialist has wrapped up streamlining the onboarding handle and making it simpler for new account holders to connect. Account-holders can presently open their annuity accounts beneath the Atal Benefits Yojana without employing a versatile app or the web-keeping money framework.

- Contact the Financial institutions in which you have already a savings account for the APY enrollment. Offical website Link.

- Visit the location from where the application form is available

- When you have the registration form with you fill it up and then again return it to the Bank after filling out the details and attached documents.

- Keep your mobile number up-to-date because it is the same number you will receive all your information from the bank.

Also Read:- Pradhan Mantri Kisan Credit Card for Indian Farmers || Make In India

The key Facts of Atal Pension Yojana

- Atal Pension Yojana scheme was started in May month of the year 2015 by the Central government implementation.

- This Yojana is only available for those people who fall into a tax bracket that is not subject to income tax

- The starting age to apply for the yojana is 18 years and it ends in the year at 40.

Also Read:- Pradhan Mantri Gramin Digital Saksharta Abhiyan || Ladli Behna Yojana Maharashtra

Conclusion

The Atal Pension Yojana (APY) is one the best Yojana which was started by the Government of India because it helps families or individuals secure their future in old age time or retirement. People face financial constraints when they reach old age but now with this scheme, you can enjoy your retirement without any tension in your head for the financial issue.

Also Read:- Pradhan Mantri Jeevan Jyoti Bima Yojana(PMJJBY) || Ladli Behna Yojana 3rd Round

FAQ’s About Atal Pension Yojana

Q1- How will you confirm that your APY account has been activated?

A – When you submit the form it will be processed, so after some days, you get a text message on your number related to the activation of your account.

Q2- How many rupees do you have to enroll each month for the APY plan?

A – The rupees will depend on your plan scheme but the starting charge is INR 1000.

Q3- What is the exit age of the APY plan?

A – The exit age of the APY plan is 60 years, so after 60 years, you can close your APY account.