The government is consistently introducing new schemes to reduce unemployment and create job opportunities for people. If you are interested in starting your own business, there is a special loan program called the Pradhan Mantri Mudra Yojana. You can get a loan of up to ₹10 lakh through this program. To access this loan, you will need to provide certain documents. By fulfilling these requirements, you can easily take advantage of this scheme.

If you want to start your own business using this government scheme, this article is important for you. Here, you will find complete information about the Pradhan Mantri Mudra Yojana so you can benefit from this scheme.

What is the Pradhan Mantri Mudra Yojana?

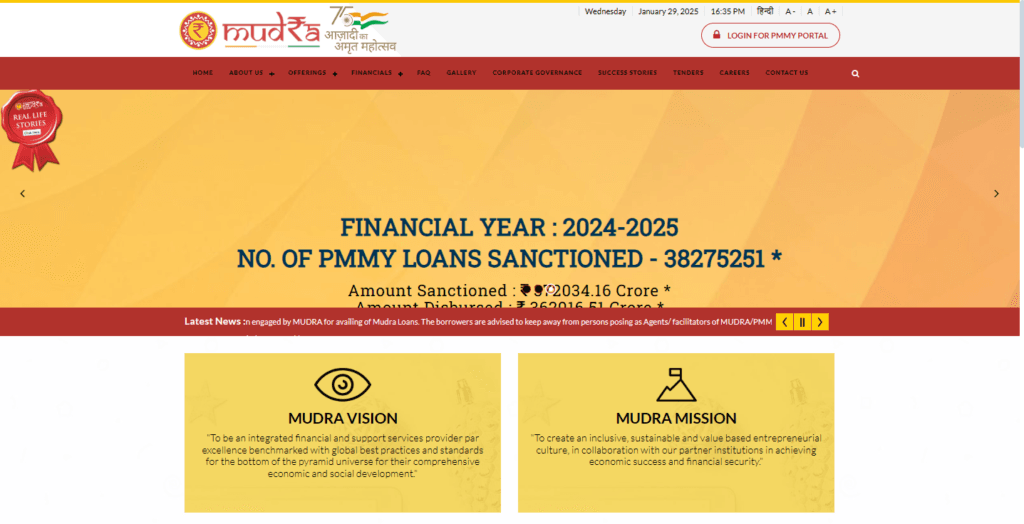

The Pradhan Mantri Mudra Yojana (PMMY) was announced by Finance Minister Arun Jaitley during the Union Budget presentation for 2016. On April 8, 2015, the Prime Minister officially launched Mudra Yojana. The main goal of Pradhan Mantri is to create a financial system that helps small borrowers get loans from different financial institutions; Public Sector Banks, Regional Rural Banks, Cooperative Banks, Private Sector Banks, Foreign Banks, Micro Finance Institutions, and Non-Banking Finance Companies.

You can get a loan through this scheme without any processing fees. Apply for the loan at your nearest bank. The interest rate depends on the loan amount and is between 10% and 12%.

| Name of the scheme | Pradhan Mantri Mudra Yojana |

| who started it | Central government |

| Beginning of the plan | 08 April 2015 |

| Beneficiary | Small Business |

| Loan Amount | 50,000 to 10 lakh |

| Official website | https://www.mudra.org.in/ |

Note: Nirmala Sitharaman had announced doubling the loan limit under the PM Mudra Yojana and said that the increased loan limit can be availed by such businessmen who have fully repaid the loan taken earlier under the Tarun category in PM Mudra Yojana.

Term & Condition:

That is, if they have repaid their old Mudra loan, then only they will be provided with double the loan.

Pradhan Mantri Mudra Yojana Logo

Features of Pradhan Mantri Mudra Yojana

| Loan Types | Term Loan, Working Capital Loan and Overdraft Facility |

| Types of Mudra Scheme | Shishu, Kishore and Tarun |

| Loan Amount | Loan amount up to ₹10 lakh(The 2024 Budget has increased the loan amount to ₹20 lakh.) |

| Interest rate | As per the applicant’s profile and business requirements |

| Collateral / Security | not necessary |

| Payment Term | 12 months to 5 years |

| Processing Fees | You may have to pay nothing or 0.50% of the approved loan amount, depending on your bank or loan institution. |

Also Read: Mahatma Jyotiba Phule Jan Arogya Yojana | Gujarat Sanman Portal 2025

Benefits of Pradhan Mantri Mudra Yojana

- You can get collateral-free loans, which means you don’t need to provide any security to banks or NBFCs.

- These loans have no processing fees and offer low interest rates.

- Women entrepreneurs can take advantage of lower interest rates.

- The government of India provides credit guarantee schemes for these loans.

- You can use Mudra loans for term loans, working capital loans, and overdraft facilities.

- All small or micro, non-farm enterprises can apply for Mudra loans.

- People from SC/ST/Minority categories can get special interest rates on Mudra loans.

Also Read: Benefits of Bihar Labour Card | Benefits of Bihar Rojgar Mela | Benefits of Sewayojan Portal

Types of Pradhan Mantri Mudra Yojana

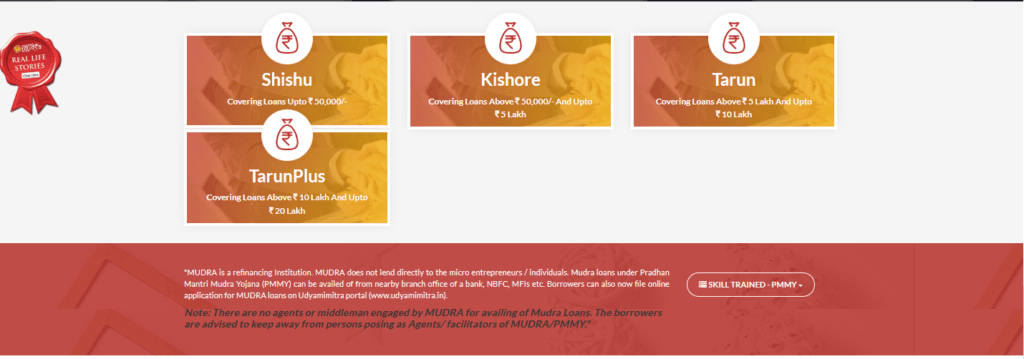

The Pradhan Mantri Mudra Yojana (PMMY) provides three types of loans based on what entrepreneurs need.

| Name of the Type of Loan | Coverage of the Loan |

| Shishu | Maximum ₹50,000 |

| Kishor | Above ₹50,000 up to ₹5,00,000 |

| Tarun | Above ₹5,00,000 up to ₹10,00,000 |

Eligibility for Pradhan Mantri Mudra Yojana

To benefit from this scheme, the applicant must meet the following requirements:

- 1. The applicant must be an Indian citizen.

- 2. The applicant must be at least 18 years old.

- 3. If the applicant has unpaid debts to any bank, they will not qualify for this scheme.

- 4. The applicant must understand all details about the business for which they want the loan.

Documents Needed for Pradhan Mantri Mudra Yojana

Bank officials may ask for these documents for Pradhan Mantri Mudra Yojana Loan:

- Business plan

- Application form

- Photograph of the applicant

- Proof of Identity (documents like Aadhaar, Voter ID, Driving License)

- Proof of residence (documents like Aadhaar, Voter ID, telephone bill, bank passbook)

- Proof of Income (documents like ITR, Sales Tax Return)

- KYC

Note:

- 1) Candidates from the SC, ST, OBC, or Minority categories will be required to submit a certificate that proves their respective status along with their application.

- 2) Attach your business registration, license, or related certificate to your application if you have any.

- 3) An ITR is usually not needed for loans that are less than Rs 50,000.

How to Apply for Pradhan Mantri Mudra Yojana Online 2025

To get a loan under the Pradhan Mantri Mudra Yojana, follow these steps:

- 1. Visit the Official website “https://www.mudra.org.in/” for the loan scheme

- 2. You will find their options for the Shishu, Kishor, and Tarun loans.

- 3. Click on a loan you prefer.

- 4. You will be able to get a link that leads to your application form.

- 5. Save the application form on your computer or laptop as it is in a PDF format so that you can take a printout of it.

- 6. Fill your form carefully after attaching all important documents.

- 7. Submit your application form to your nearest bank.

- 8. After confirmation, the loan amount will be transferred to your bank account.

Also Read: Mukhyamantri Kanya Utthan Yojana | Bihar Mukhyamantri Kanya Vivah Yojana

List of Businesses Covered Under Pradhan Mantri Mudra Yojana

Here is a list of businesses that can get support under the Mudra Yojana:

- You can use Mudra finance to buy commercial transport vehicles like tractors, auto-rickshaws, taxis, trolleys, tillers, goods transport vehicles, three-wheelers, and e-rickshaws.

- Service Sector Activities: Starting businesses like salons, gyms, tailoring shops, medical shops, repair shops, dry cleaning services, and photocopy shops.

- Activities in the Food and Textile Products Sector include making items like papad, pickles, ice cream, biscuits, jams, jellies, and sweets. It also covers preserving farming products at the rural level.

- Business activities for traders and shopkeepers include starting shops and service businesses. They also involve trading, professional work, and other non-farm activities that help earn income.

- Agriculture Activities: Agri-clinics and Agri-business Centers, food and agro-processing units, poultry farming, fish farming, bee-keeping, sorting, livestock raising, grading, agro-industries, dairy farming, and fisheries are all types of agriculture-related businesses.

Note: Banks and NBFCs offer Mudra loans to individuals, businesses, or enterprises in the services, trading, or manufacturing sectors.

Banks Offering Mudra Loans

Here is a list of banks that provide Pradhan Mantri Mudra Loans:

| Axis Bank | Indian Bank |

| Yes bank | Karnataka Bank |

| Bank Of Baroda | Kotak Mahindra Bank |

| Bank of India | Lendingkart Finance |

| Bank Of Maharashtra | Punjab National Bank |

| Canara Bank | Saraswat Bank |

| Central Bank Of India | State Bank Of India |

| HDFC Bank Ltd | Syndicate Bank |

| ICICI Bank | Tata Capital |

| IDFC First Bank | Union Bank Of India |

Comparison with other banks/loan institutions

| Banks/NBFCs | Banks/NBFCs |

| Axis Bank | 10.75% p.a. |

| Flexi | Starting from 1% per month |

| HDB Financial Service Limited | 8% – up to 26% p.a. |

| HDFC Bank Ltd | 10.75% – 25% p.a. |

| IDFC First Bank | 10.50% p.a. |

| Indifi | Starting from 1.50% per month |

| Kotak Mahindra Bank | 16% – 26% per annum |

| Lendingkart Business Loan | 12% – 27% per annum |

| Mcapital | Starting from 2% per month |

| NeoGrowth Finance | 15%-40% per month |

| Tata Capital | 12% per annum |

| You Gro Capital | 9% – 36% per month |

What is a Mudra Card?

A Mudra card is a debit card provided to the Mudra loan borrower since this card facilitates their business and working capital needs. Once the bank or financial institution has agreed on the Mudra loan, they open that person’s special Mudra loan account and issue a debit card. This means the amount of that loan gets transferred into this particular account. The beneficiary can withdraw the amount according to whatever his business needs are.

Additional Information

Extra benefits are extended to women entrepreneurs and Scheduled Caste (SC) or Scheduled Tribe (ST) category persons. The person availing these loans will receive low interest rates, as well as rapid processing of applications.

FAQ’s For Pradhan Mantri Mudra Yojana

Q: Who can apply for the Pradhan Mantri Mudra Yojana?

Ans: Applicants under the Pradhan Mantri Mudra Yojana have to be an Indian citizen aged 18 years and above. Only such applicants who have not defaulted in previous loan availing services are allowed under this scheme.

Q: What is the largest loan amount available under the Pradhan Mantri Mudra Loan Scheme?

Ans: You can apply for a loan amount between ₹ 50,000 to a maximum of ₹ 10 lakh. The sum received will be based on the specific type of loan you are considering: Shishu, Kishor, or Tarun.

Q: What is the interest rate for the Pradhan Mantri Mudra Loan Scheme?

Ans: This plan will ensure that your interest rate on the loan will be in the range of 10% to 12%. The bank will determine your interest rates as per your loan amount and its particular set of terms and conditions that suit the case best.