The NPCI Aadhaar link bank account process is very crucial for getting government subsidies and Direct Benefit Transfers in India. In case you link your Aadhaar number with your bank account properly through the National Payments Corporation of India, you can receive money for government schemes straight into your account via the Aadhaar Enabled Payment System. So it allows delay free transactions, makes the whole benefit giving process clear and enables quicker access to welfare programs.

Almost all state services like scholarships, old age pensions, and social welfare schemes that are available on platforms such as the digital gujarat portal require an Aadhaar linked bank account for hassle free fund transfers. Therefore knowing how to do the NPCI Aadhaar link bank account process is necessary for all India residents.

This guide covers not only the step by step linking procedure but also eligibility, benefits, easy instructions, safety tips, frequent issues, and solutions. It aims to assist you in linking your account smoothly and without any doubt.

What NPCI Aadhaar Link Bank Account Means?

Aid to local Governments and State run organisations in India, NPCI Aadhaar linking of a bank account involves the process of associating your thenetworking number with your bank account through the National Payments Corporation of India. The NPCI is the central organisation that operates the Aadhaar Enabled Payment System and thus ensures that any kind of governmental transfers that you might be entitled to are sent to your main bank account that has a connection with your Aadhaar.

Upon your consent for Aadhaar integration with your bank, NPCI is responsible for making the changes in your Aadhaar linking so that all Direct Benefit Transfers can be routed to the right account.

So the LPG subsidy, ration subsidy, pension, scholarship fee and many welfare programs run by the government can benefit from this. Punjab and Haryana consumer online services portal users applying for state level services in Haryana can smoothly transfer funds only if their accounts are correctly mapped with Aadhaar enabled accounts.

Why NPCI Aadhaar Linking Is Important?

Connecting your Aadhaar with your bank account through NPCI is very important as:

- With this connection, all the welfare that come from the government are directly credited to your account on time.

- The involvement of middlemen is almost completely eliminated and transparency gets improved as well.

- There is no doubt that you can easily get the subsidies both from the central and the state governments if you have an Aadhaar link.

- Aadhaar based authentication becomes more convenient when one can access different services using the same method.

- In case you are not aware of wrong account numbers or inactive accounts, linking is a must to be free from missing payments.

Those users who are very regular on the digital Gujarat portal for availing services like scholarships, social security programs, and citizen benefits usually get the advantage of speedy payments once their Aadhaar based account mapping gets accomplished.

Eligibility for NPCI Aadhaar Link Bank Account

Any person living in India who has a valid Aadhaar number and an active bank account can go through this process. What you need is just:

- An Aadhaar card or the number

- An active savings or current account

- A mobile number registered with the bank

Also, users applying for new schemes via the digital gujarat portal must have an Aadhaar linked account to be able to receive the money.

Documents Required

For Aadhaar seeding, you do not require a lot of documents. In most cases, the following should be sufficient:

- An Aadhaar number or a physical Aadhaar card

- A bank passbook or account details

- A mobile number that is registered both with Aadhaar and your bank

How to Link Aadhaar with Bank Account Through NPCI?

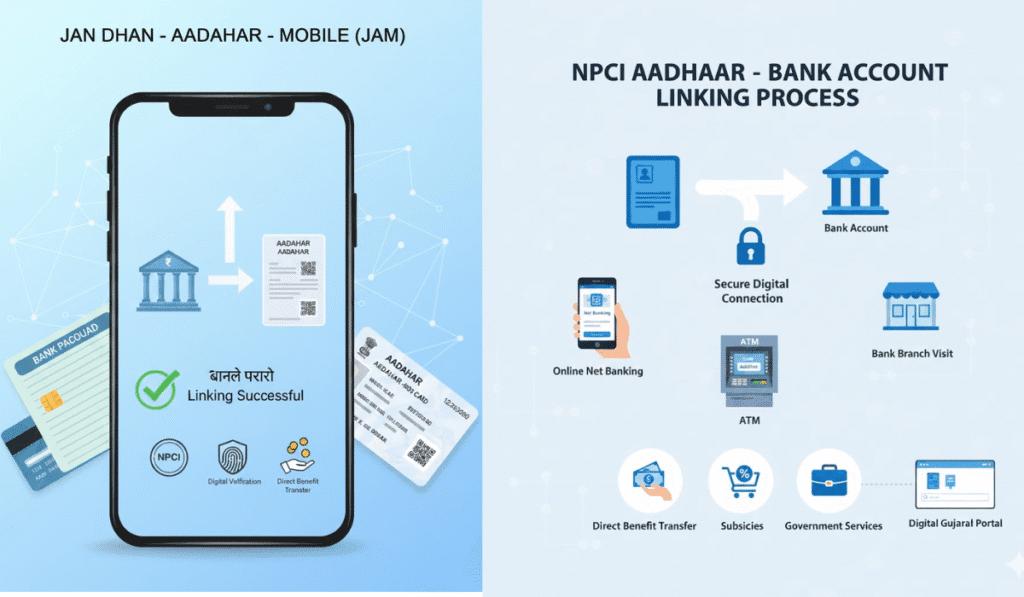

You can select from a variety of methods to carry out the linking that best suits your situation. Mostly, the following ways are being used.

Link Aadhaar with Bank Account Through Net Banking

Aadhaar seeding through net banking portal is the common facility provided by most major banks.

Steps:

- Go to your bank’s website and log in to your net banking account.

- Head over to the service or request section.

- Find Aadhaar update or Aadhaar linking option.

- Type your Aadhaar number twice for confirmation.

- Submit the request and wait for the bank’s verification.

- After approval, the bank sends the details to NPCI for the final mapping.

Net banking is one of the quickest ways to complete the NPCI Aadhaar link bank account process. A large number of applicants who later on use the digital Gujarat portal for benefit schemes choose this method due to its speed and convenience.

Link Aadhaar with Bank Account Through Mobile Banking

If you have the official mobile app of your bank, you can also do the linking process very simply.

Steps:

- Open your mobile banking application and log in.

- Go to the services or account management section.

- Click on Aadhaar registration or Aadhaar seeding.

- Type your Aadhaar number and verify it.

- Send the request and take it easy until a confirmation comes to you by SMS.

This method is perfect for smartphone users and thus provides a smooth digital experience as many services are available on the digital gujarat portal.

Link Aadhaar with Bank Account by Visiting the Bank Branch

If you want a method that doesn’t require internet, bank branch visit will be your choice.

Steps:

- Make sure you carry your Aadhaar card and go to the nearest bank branch.

- Request the form for linking Aadhaar.

- Write down your bank account number and Aadhaar number.

- Hand over the filled in form and your Aadhaar card photocopy to the bank.

- The bank official will update your request for linking Aadhaar.

- After the approval, NPCI will carry out the integration.

This method is closest to grandma and grandpa’s hearts or users who are not tech savvy.

Visit Also : Swamitva Yojana | Gogo Didi Yojana | Mangla Pashu Bima Yojana

How to Check NPCI Aadhaar Link Bank Account Status?

You can verify your status by:

Checking on Your Bank Website or App

Most banks provide an option for checking the status of Aadhaar in the service section. NPCI will let you know if your Aadhaar is active and mapped.

Checking via the UIDAI Portal

If you want to know whether your bank has accepted your request, you can confirm it by visiting the local service portal and checking that your Aadhaar number is linked to the bank account. Once the mapping is done at NPCI, it is usually completed in a very short time.

At Your Bank Branch

You can find out whether your Aadhaar has been seeded and the NPCI mapping is active by asking the help desk officer.

Through an SMS

Some banks have given birth to SMS based Aadhaar status services. Registered users who want to do this, just need to send a keyword from their registered number.

Status performing is very essential to scholarship holders, pensioners, or welfare schemes users who operate on the digital Gujarat portal as payments will only come once the mapping is activated.

Benefits of Completing NPCI Aadhaar Link Bank Account

Using NPCI to link Aadhaar gives you several advantages.

- Faster and timely Direct Benefit Transfers

- Direct credit of LPG subsidy, pension, scholarship and welfare payments

- Easy execution of state services dependent on Aadhaar based disbursement

- Less paper work and fewer visits to bank branches

- Improved security through Aadhaar based identity verification

- Single primary account for all government transfers

Such advantages and more are at the disposal of individuals who are beneficiaries of schemes through the digital gujarat portal where a vast number of transactions are executed via Aadhaar enabled accounts.

Safety and Security Aspects

Aadhaar linking via NPCI is safe as:

- Banks do the verification of your Aadhaar through very secure and trusted channels.

- NPCI employs encrypted methods to link Aadhaar with accounts.

- At the most, one account can be active for Aadhaar based payments which is a safety measure against the unauthorized use of your account.

- For each update or transaction, you get SMS notifications.

Do remember that it is most important not to share your OTP or any other banking information that is confidential with anyone.

Common Issues and Solutions

Aadhaar Not Updated

In some instances, banks reject your request if there is a mismatch between your Aadhaar details. So, update your Aadhaar information at the enrollment center and give it another shot.

Mobile Number Not Registered

Make sure that the mobile number linked to your Aadhaar and the mobile number registered with the bank are both updated.

NPCI Mapping Delay

It may take some time for the National Payments Corporation of India to update the mapping. So, you can check the status after a day or two.

Account Not Active

Make sure that your bank account is active and not dormant. Otherwise, the process of linking an NPCI Aadhaar bank account cannot be carried out.

These steps matter to those who are filing applications for different schemes on the digital Gujarat portal as their payments may get delayed if there are issues with Aadhaar mapping.

Practical Tips for Smooth Linking

- Ensure that your phone number linked with Aadhaar is the same as that of your bank.

- Do the transactions through the internet or mobile banking to get the work done quick.

- Verify whether you are correctly mapped with NPCI before filing a request for government schemes.

- Make sure that your Aadhaar card always has the right information.

- If you cannot do it through the internet, then go to the bank branch.

Connection with Digital Gujarat Portal

Several people in Gujarat have also been utilizing the digital Gujarat portal on a regular basis for the above mentioned activities. To give you a clear picture of the most common digital Gujarat portal services usage, we have a glance at the below: Along with many other services, these services most of the time ask for a proper bank account which is linked to Aadhaar so that money can be injected through Direct Benefit Transfers. In this way, finishing the NPCI Aadhaar link bank account steps is one of the main reasons for ensuring the smooth flow of payments when you select the digital Gujarat portal for benefits. It thereby becomes simple for the citizens to obtain the financial assistance without any kind of delay.

Conclusion

Filing the NPCI Aadhaar link bank account operation is very easy and is a step that every Indian citizen should take. It is the main vehicle for the subsidies, scholarships, pensions and all other welfare payments to be transferred on time. The operation is a simple one and also safe irrespective of whether you perform it through net banking, mobile banking, ATM or bank branch.

In case you intend to apply for a state or central government scheme or use the digital Gujarat portal and other similar platforms, then it is necessary that your bank account which is enabled for Aadhaar is active and mapped through NPCI. Find out your status today and if linking is at a standstill, get it done so that you won’t lose out on the benefits that you are entitled to.

So, with this knowledge, you can go ahead with the linking process and then have hassle free access to all government financial services.

FAQs

- What is NPCI Aadhaar link bank account

Through the National Payments Corporation of India, it is the linking process of your bank account with the Aadhaar number so that the Direct Benefit Transfers and subsidies can be sent to your account.

- Is it necessary to link my bank account with Aadhaar

Definitely, if you want to enjoy government subsidies, scholarships, pensions or welfare payments, including those implemented through the digital gujarat portal.

- How long does NPCI mapping take

Typically, banks finish the Aadhaar connection on their side within a few hours or a day. After that, the NPCI linkage may take anywhere from one to three working days.

- Can I receive subsidies in multiple bank accounts

No, it is only possible for one bank account to be designated as the receiver of Aadhaar based payments. The most recent linked account automatically becomes the primary account.

- How do I know if my bank account is linked with my Aadhaar

There are several means of checking: net banking, mobile banking, the UIDAI portal, SMS service or through your local bank branch.

- What if my Aadhaar details are different from those of the bank records

You will have to align your details either by the bank or an Aadhaar centre before you ask for Aadhaar seeding again.

- Is it possible to do the linking without a mobile that is registered

No. There has to be a mobile that is registered as the various ways in linking have a point where the OTP needs to be verified.

- Does the digital gujarat portal require an Aadhaar linked bank account

Yes. Most of the schemes that are on the digital gujarat portal have as a requirement NPCI mapped Aadhaar enabled accounts so that Direct Benefit Transfers can take place in a hassle free manner.

- Is linking with Aadhaar safe

Indeed, banks alongside NPCI do their work in robust and safe encrypted systems. The ways in which you can keep safe are by not sharing with anyone your OTPs, PINs or personal info.

- What happens if my account gets closed while I am linking my bank account

There is a possibility that your account is dormant and the linking request might not succeed. If you re activate the account by getting in touch with your bank and then try the process again, it will be accomplished.

You may also like this : Mahiti Kanaja Gruhalakshmi | Vivad Se Vishwas Scheme | Gold Monetization Scheme